Financial related challenges are a reality for all enterprises, but they can be especially challenging for business owners who are trying to get out of the gate without going broke in the process.

Keeping an enterprise going isn’t for the faint of heart. While 80% of enterprises make it through year one, only 70% are still operating at the end of the second year. By the time they hit the five-year mark, only about 40% of these enterprises are still in business.

Of those enterprises who shut their doors, nearly half point to a lack of funding. Put simply, not enough money was coming in for them to pay employees or cover other operational expenses.

In this article, we’ll look at five financial challenges that enterprises typically deal with and show how to overcome them – and beat the odds.

The goal is to keep your enterprise solvent, profitable and productive. Some of the biggest challenges faced by enterprises are as follows:

Limited or inconsistent cash flow

Not using a budget

Not raising enough capital

Too much debt

Poor marketing tactics

Challenge nr. 1 – Limited or Inconsistent Cash Flow

Most enterprises struggle with managing cash flow. From simply invoicing effectively to secure sufficient cash inflows to cover the monthly bills to accumulating cash to invest in growth and liquidity is an ongoing challenge. Here are some tips for managing cash flow:

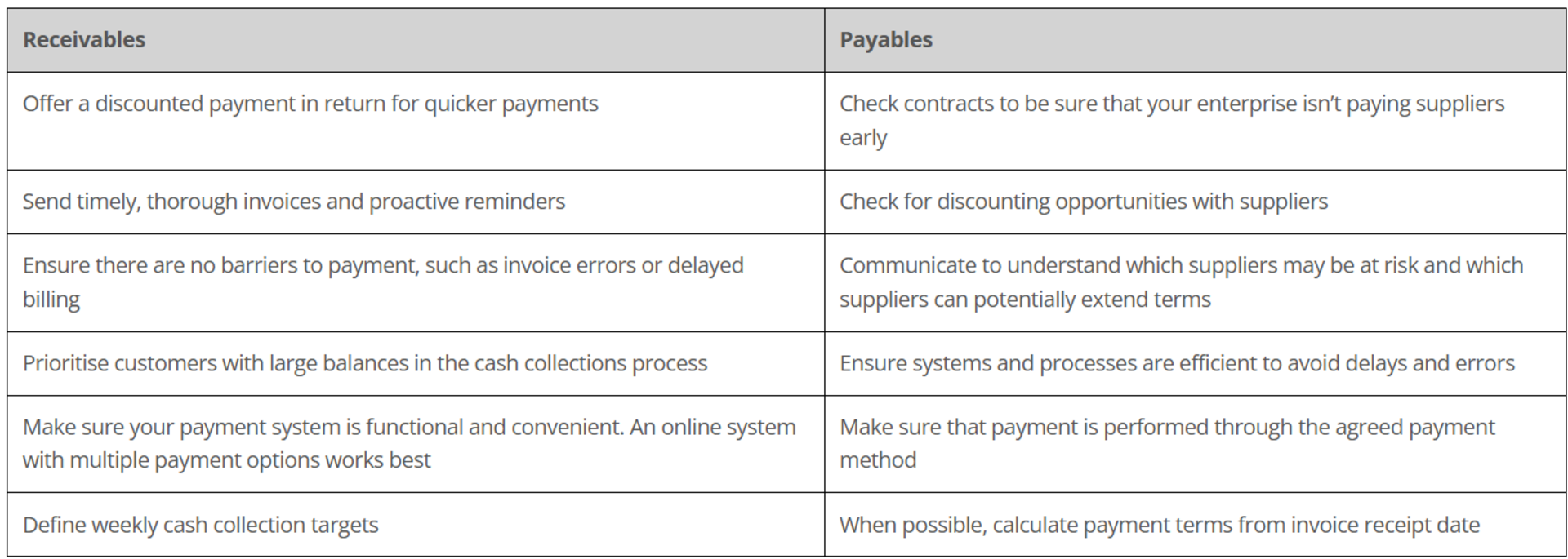

Diligent cash flow practices involve balancing accounts payable and accounts receivable. By maximising the cash-to-cash conversion cycle, enterprises ensure access to capital.

Challenge nr. 2 – Not Using a Budget

If you’re running your enterprise by the seat of your pants, just hoping that there will be enough in the bank to pay the bills at the end of the month, it won’t take long to wind up with more debt and financial responsibilities than you can handle.

Consider to develop and stick to a budget. Doing so will not only help you plan for the future, it will also give you a tool for analysing expenditures and the ability to change direction quickly when needed.

Regularly update and revise your budget to reflect current circumstances and use it to make good business decisions.

Challenge nr. 3 – Not Raising Enough Capital

The first thing to know is that funders are averse to any form of risk and therefore start-ups are very unlikely to get any funding. Your enterprise generally needs to be established and have a 3-year track record to even start applying for funding. Research also shows that individuals who have a better understanding of their enterprises` credit scores are 40% more likely to be approved for a loan.

There are a number of paths to raising capital:

Venture funding for early-stage enterprises with strong growth potential.

Private equity for those willing to give up shares of the enterprise in exchange for cash now.

Government development funds soft loans or grants, loan amounts are typically small and is difficult to access.

Bank loans are strongly dependent on good collateral and stable, growing revenue and profitability.

Friends and family and personal savings.

How to improve your chances of getting a loan, attracting an investor or otherwise accessing capital?

Have a business plan, in writing, and potentially a pitch deck.

Work to improve your credit score.

Make sure your cash flow, P&L statements and balance sheet are updated, accessible and auditable.

Challenge nr. 4 – Too Much Debt

Entrepreneurs are rightfully proud of “bootstrapping” their way to success, so it’s not unusual for business owners to take on debt to launch their enterprises. But there absolutely is such a thing as too much business debt.

Whichever debt vehicle was tapped into, these situations can have significant short- and long-term impacts on your enterprise.

Here are five steps you can take to minimise your debt levels and get your finances back on track:

Identify areas where you can reduce costs.

Perhaps you can sublease unused office space or sell excess equipment.

Use runway extenders:

Stay connected with your customers and seek out ways to increase your visibility.

Improve your business model, and thus your revenue.

Offer your best customers markdowns if they can pay you more quickly.

Contact your suppliers to arrange discounts and/or deferred payments.

Consider creative financing options for ways to raise cash without big payments.

Angel investors,

Crowdfunding,

Accelerators

Contact every creditor and advise them of your predicament. Ignoring your lenders will only make matters worse, while tackling a debt problem is easier when you act early. Since it’s in everyone’s interest to find a solution, request that your lenders collaborate with you to:

lower interest rates,

increase your credit line or

restructure your repayment period.

Consolidate your business loans into one payment, which may reduce monthly costs without negatively affecting your credit score. A business debt consolidation loan can allow you to deal with a single creditor rather than many and perhaps get a lower interest rate over a longer period of time.

Challenge nr. 5 – Poor Marketing Strategy

If you are not continually signing up new customers, you’re ceding them to competitors. And while other enterprises can get by serving the same handful of clients year after year, enterprises with growth and profitability aspirations need new clients to help them achieve those goals.

To get these clients, business owners must deploy marketing strategies that attract, engage and retain customers.

Remember that you have never exhausted sales to your current customers, always look for ways to upsell or sell new products or services to existing customers.

Do you also need any of the following services?

Business advisory support/Accountability partner?

Business finance?

Banking facility audit?

Family business advisory services?

Calculate the fair market value of your business?

Speak to your SFP Financial Planner who will introduce you to the designated Subject Matter Expert on the SFP ENTERPRISE panel who would be able to address your specific business need or requirement.

SFP is a licensed financial services provider.