An enterprise has a myriad of moving parts. Many entrepreneurs and business owners are not formally skilled nor experienced to manage the full extent of what is needed to make everything in their business run like clockwork.

In his best-selling book, “the E-Myth” or “The Entrepreneurial-Myth”, Michael Gerber presented us with a very logical approach to this reality. He said that an entrepreneur or business owner is three people combined in one.

Technician – knowing the work the business does

Manager – managing the resources of the business

Entrepreneur – finding and attracting new business opportunities

Most business owners are technicians. They are trained, skilled, have experience to fulfil a specific job, and are usually brilliant at what they do. Examples include a builder, lawyer, service provider or chef. One day they decide to quit their job and start a business. They think because they know the technical part of the work, they also know how to manage the business. They easily get caught up in doing “all the work”, i.e., working “in” the business and not “on” the business.

This is usually the reality when you start out on a business journey – to be the chief cook and bottlewasher. You might not have the luxury to delegate work and responsibilities to other staff members. In the beginning, you should accept that the different personalities are par for the course. If you are not skilled in business management nor have the experience to market and sell your product or service, you would need to read up on the topics or attend short courses to learn the basics of these topics.

As your business grows and the cash flow improves, you can appoint people in the business to fulfil the jobs you are not good at or do not have a bias to do.

The questions, therefore, are:

Which is your prominent personality preference and which one(s) are your Achilles heel?

How are you going to address the personalities where you find yourself lacking?

The second blind spot comes into play when you do not have a 12–18-month cash flow forecast in place and do not monitor the real progression of income and expenditure against the budgeted amounts monthly. The moment you have a forward-looking view of the finances of the business, you are putting yourself in a proactive position to address potential shortfalls. A downward trend in turnover can be anticipated and addressed and will therefore not be in your “blind spot”.

I trust that these questions will empower you to put risk and financial wellbeing solutions in place which will support the sustainability of the enterprise and serve the financial needs and requirements you and your staff have. Remember that your financial plan needs to address your unique circumstances and affordability parameters.

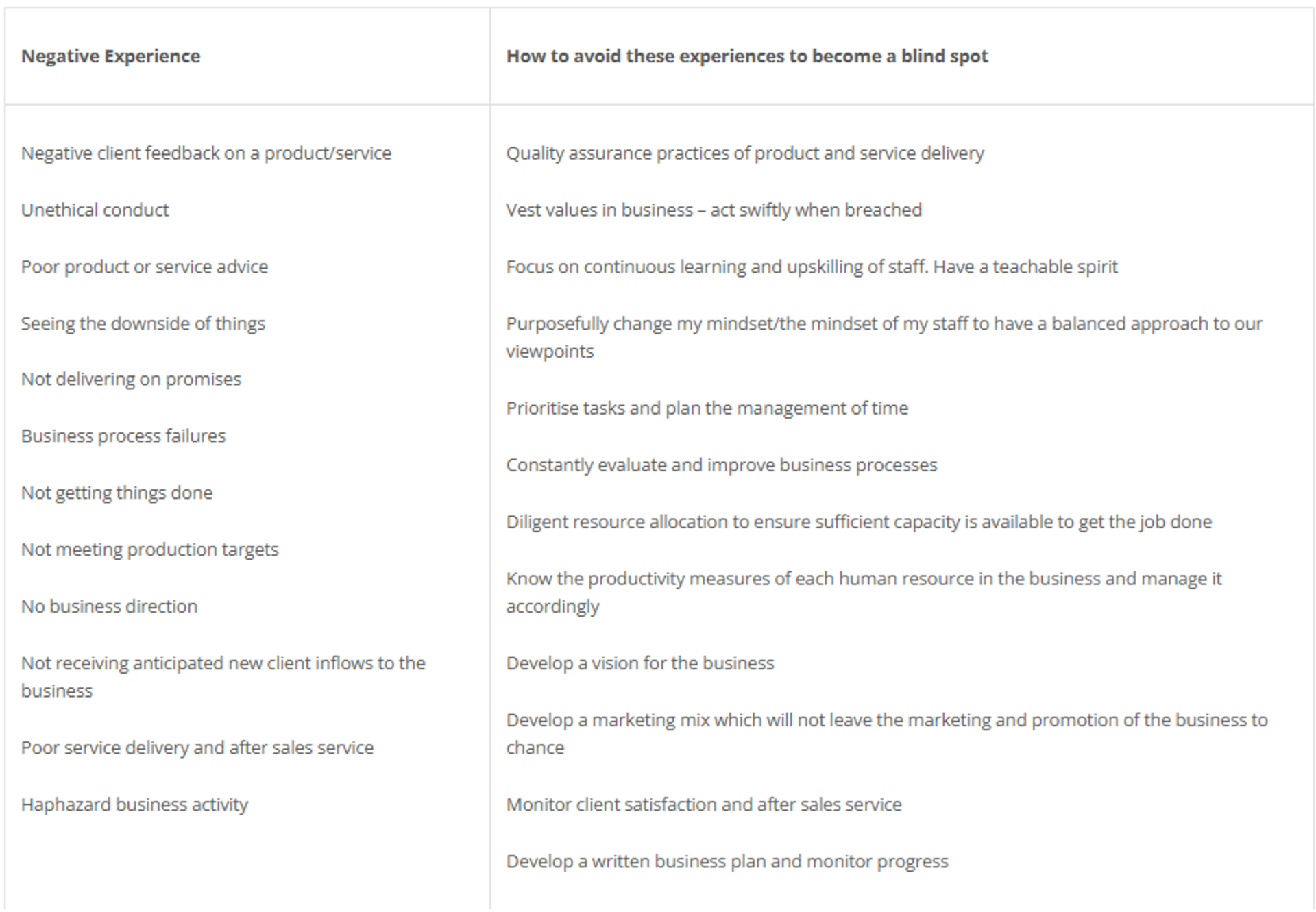

A third blind spot can also be created if we do not understand which things are within our span of control as owners of a business. We might look at the external environmental factors like loadshedding, interest rate hikes, political instability, etc. and become despondent to “think outside the box” by influencing and managing the things which are within our span of control. I have had the privilege to support over 100 businesses with their 2023 business planning. I brainstormed this topic with them and I was astonished by how many things a business owner can control and influence. Without thinking about this purposefully, it can become blind spots in managing your business.

Below is a partial list of things which business owners can influence or control to limit or alleviate blind spots.

Blind spots can be avoided with the support of the following knowledge resources:

If more than one owner – divide the roles and responsibilities in the business to align it with the skills and experience of each owner

Contract the support of a business advisor or – coach

Appoint a “mastermind group” with whom you meet frequently. This group can include your banker, financial adviser, accountant, tax specialist and possibly a successful business owner

Do you also need any of the following services?

Business advisory support/Accountability partner?

Business finance?

Banking facility audit?

Family business advisory services?

Help with the buying or selling of a business?

Speak to your SFP financial adviser who will introduce you to the designated subject matter expert on the SFP enterprise panel who would be able to address your specific business need or requirement.